The American Financial Crisis. Toward the end of the film “DOMINOES” there is frightening apparition: January 1972 – a man standing up in a white Cadillac convertible waves to the re-elected Nixon. The man is Ronald Reagan and the brief scene shocked me to reality; to today, to the vicious battering of the economy and why it all started with then Governor Reagan and his rise to President eight years later.

If filmmaker John Lawrence Ré included the Reagan parade route snippet to incite fear and loathing it worked. The ingenious editing and arrangement of thousands of hours of archive footage makes for a hyper-emotional political history of the U.S. between 1965 and 1975. But “DOMINOES” is more than just emotion, it an incredibly astute history of modern protest.

You have been in a drug induced coma the past months if you know nothing about the near death blows the American financial system has suffered. Theories about how we’ve come to this economic meltdown abound. Wall Street economists are not only back peddling but predicting even more incorrect scenarios for the origin of the crisis and what to do about it.

My own training as an economists taught me to distrust anything they say regarding money and business. They rank with most politicians as award winning, classic examples of the bromide: “opinions are like assholes, everybody has one, and they all stink.”

These same economists and politicians, often working hand in hand, have been getting it wrong for centuries all over the world. It’s a testament to the Natural Laws of Supply and Demand that ANYTHING goes right in an economy given all the mismanagement and misadventure that can occur. We’ll get to the misadventure shortly.

Before you glaze over, here’s a very simplified view of the Natural Laws of Supply and Demand: If there is a large supply of something that people want to buy, corn for example, the price tends to go DOWN. If the supply of that corn that people want to buy goes down, then the price tends to go UP. Not that complicated. Nature has a way of balancing things and winning every time in the long run. In the short run, humans can wreck havoc on that balance.

So WHY do I think RONALD REAGAN is the cause of the current economic tsunami? Well, let me tell you a little story.

For a nation so deeply rooted in capitalism it is astonishing how low the average American’s business I.Q. is. They view Wall Street as a quasi-benevolent group of trustworthy, pinstripe suited bankers and money managers cautiously guarding the wealth of the nation as if it were their own. Economic history shows that Wall Street DID view the nation’s wealth as their own – we’re just viewing them in the wrong pinstripes. Prison pinstripes would be more appropriate.

Leap back to 1890, just 39 years before the Great Depression of 1929, the year the Sherman Anti-Trust Act was adopted. Wall Street had been functioning with virtually no regulation of any type for almost two hundred years. More importantly, businessmen like John D. Rockefeller (oil) and J. P. Morgan ($MONEY$, oil and steel) could do anything they pleased in the markets they controlled, most often aided by Congress and state legislatures.

Before that the great monopolist Robber Barons could charge whatever they wanted for goods and services even if doing so knowingly disrupted the entire U.S. economy and caused distress and destruction. During this time the United States experienced some of the most extreme economic fluctuations – booms and busts – imaginable. Akin to and surpassing the crisis of today.

Because these booms and busts severely disrupted profits in manufacturing and mining that the monopolists controlled they “unionized.” To even out the effects of these roller coaster ups and downs many of them formed cartels to control the supply of manufactured and mined goods to ensure profits. These cartels simply fixed prices and controlled supply. Is anyone familiar with O.P.E.C. cartel and the gas crisis of 1973?

Out of this was born the concept of trusts. As a trust member you formally agreed to lower the supply of your product to raise prices to profitable levels, often obscenely profitable levels, and agreed to dump products at unprofitable prices to prevent anyone from trying to enter the business.

By the late 1880’s the public outcry against the abuses perpetrated by the trusts became too much for Congress to ignore and in 1890 they passed the comprehensive Sherman Anti-Trust Act by almost unanimous votes in both the House and Senate.

Republican President Theodore Roosevelt, a hero to many modern day Republicans, including Ronald Reagan, declared himself a trust buster. His zealous prosecution of the new law in the early years of the 1900’s, eventually brought an end to trusts.

Congress went a step further in leveling the economic playing field in 1913. They ratified the 16 th Amendment enacting a Federal Income Tax. Income taxes eventually stemmed the huge pools of capital being horded by the Robber Barons and associates. It also provided funding necessary for the rational growth of the nation’s infrastructure which had long been ignored except where monopoly interests were to be found.

Cut off from their debauched monopolistic freedom and saddled with paying taxes for the first time these wealth holders turned their full attention to Wall Street which would become instrumental to them in cashing out of these newly restricted companies.

Enormous waves of immigrants to the U.S. greeted rapid growth in the economy in the early part of the century. People yearned to share in the growth and profits of these now publicly owned companies but Congress had yet to impose any type of substantive regulation on the buying and selling of corporate securities (stocks and bonds) or on what these companies had to tell their shareholders about their financial positions. It was a perfect scenario for greed and lawlessness.

Over the next thirty years, into the Roaring 1920’s, countless working class Americans made and lost millions trading on Wall Street. A hot stock tip was as valuable as one’s health. Stories of shoe shine boys retiring at twenty were commonplace. Stock manipulators selling “House Of Cards” penny stocks outnumbered legitimate brokers and middlemen ten to one.

It wasn’t long before even more polished manipulators, like Joseph Kennedy, Sr., saw the enormous pool of private working class capital as a means to a never ending source of wealth. These educated and brilliant newcomers utilized the same shell games as the hustlers of old except they were able to legitimize their place in the financial world by aligning themselves with both politicians and the press.

Kennedy was born into an affluent and politically powerful Irish-American family and graduated from Harvard in 1912. He started his own stock brokerage in 1923 in what was still a totally unregulated market. Kennedy was skilled at techniques now patently illegal such as insider trading and controlling markets for a stock and became a multi-millionaire in the explosive bull market leading up to the crash of October 1929.

Kennedy not only controlled markets for individual stocks but the financial information about them. He chose what data to disperse to investors. No law dictated that the information be audited. Kennedy and investment bankers like J.P. Morgan had a virtual monopoly on stock information which was almost impossible for the average investor to come by.

Any of this starting to sound familiar? Does the term HEDGE FUND come to mind.

An anecdotal story that Kennedy never denied was that he made his decision to sell out all of his stock positions when he heard that his favorite shoe shine boy no longer worked at the stand because he had made so much money in the market. “If my shoe shine boy could make those kinds of profits, it was time to get out,” is what Kennedy was purported to have said.

Public outcries forced Congress in 1934 to safeguard the economy and investors by creating the Securities and Exchange Commission (SEC) to regulate the sale of stocks, prevent manipulation, and insure proper and adequate financial reporting by publically traded companies.

Once out of the ten year economic malaise of The Great Depression the U.S. economy began to grow and flourish virtually unabated for the next sixty years. But something happened in 1980 that would begin the unraveling of this growth and would precipitate our present economic emergency: the country elected Ronald Reagan President of the United States.

Reagan was elected after Carter’s presidency had endured the wrath of O.P.E.C., the oil cartel, which raised oil prices overnight and cut supply like the Robber Barons of old and created an economic crisis environment of both rapid inflation and a shrinking economy known as stagflation.

In addition, Muslim student radicals in Iran deposed the Shah ushering in an ultra conservative America bashing government headed not by elected officials but by religious extremists. During the turmoil the Muslim radicals kidnapped 52 Americans and held them for 444 days. Carter, unable to negotiate their release successfully was overrun by the tough talking Reagan in the election. Many political insiders acknowledge that the hostage crisis was extended by negotiations between the Reagan campaign and the Muslim radicals to last through the 1979 election to insure his victory. They were released in January of 1980 after his election.

Reagan was swept into office promising across the board tax cuts, radically increased Defense spending, stern social spending cuts aimed at balancing the budget, and reduced regulation of business. “Reaganomics,” and its theory that putting more money into the hands of investors and businesses would eventually “trickle down” into the hands of the working class became the national mantra. His guide in all this?…Arthur Laffer an economist who’s track record has yet to include one correct economic prediction.

Reagan’s Secretary of the Treasury and later, chief of staff, Donald Regan (former Chairman of stock brokerage firm Merrill Lynch from 1971 to 1980) guided Reagan in the first step that would eventually result in the present crisis. He convinced Reagan that stock brokerage firms should be allowed to act more like banks and insurance companies. He had already succeeded in 1971 in crafting legislation that allowed stock brokerage firms to go public but with less government scrutiny than before, which Merrill, Lynch promptly did.

Next Reagan gave the go ahead to deregulate the nation’s Savings and Loan industry, once highly regulated and monitored.

Reagan’s economic plan produced not balanced budgets and increased economic activity, but enormous, record deficits, the failure of almost 800 Savings and Loan associations, and the stock market crash of 1987. The Genie was out of the bottle.

Clinton was elected, in part, because of his more measured approach to the economy. To his credit Clinton managed to balance the budget seven of eight years and the country saw some of the most unprecedented economic growth in the nation’s history.

Enter Robert Rubin, first as a close economic advisor to Clinton from 1993 to 1995, then as Treasury Secretary from 1995 to 1999. Rubin, a 26 year veteran of investment banking house Goldman Sachs sponsored and presided over new regulations that deregulated hedge funds making them free of any government oversight.

Hedge funds, enormous private pools of unregulated capital, along with their kissing cousins investment banking firms and stock brokerage companies experienced record profits during George Bush’s eight year presidency. This broad freedom, harkening the days of the Robber Baron’s “trusts,” produced increasingly sophisticated financial dealings and instruments, all out of the range of government regulation. The buzz word of the last five years?: DERIVATIVES.

Hedge funds began buying individual mortgages from banks (in retrospect mortgages that would never be paid off) and bundled them to resell as Mortgage Backed Securities. These were then sold again in secondary and third markets, namely derivatives.

AIG, an insurance company, was allowed to sell insurance that guaranteed the bonds of major U.S. corporations and financial institutions like investment banker Lehman Bros., a major trader in these “mortgage backed securities” and in their secondary or derivative market. One morning in September of 2008 Lehman Bros. announced that, despite assets of almost $650 billion, they were bankrupt. AIG, once headed a man to whom government assistance was anathema, announced it couldn’t possibly meet the demands of the guarantees they had made to the bondholders of Lehman Bros. and called for immediate government assistance.

Enter Henry “Hank” Paulson, Bush’s Treasury Secretary, another lifetime Goldman Sachs employee who left the firm after earning over $500 million dollars in compensation. Lehman, a fierce competitor of Goldman Sachs was allowed to die on the vine and was absorbed by Barclay’s a British bank for pennies on the dollar. Goldman Sachs, Paulson’s alma mater, became part of what is now known as the Bush bailout.

In eight years of Clinton we saw controlled growth, a balanced budget and the longest extended period of economic growth and prosperity in modern U.S. history to Bush’s Reaganesque return to unrestrained, unregulated greed and profiteering, even bigger deficits, to trillions of tax dollars committed to salvaging and undoing the results of that deregulation.

How did we allow this to happen and WHY are we not demanding that those responsible be brought to light? Why does no one tie the scofflaw tactics of Ronald Reagan to the present crisis?

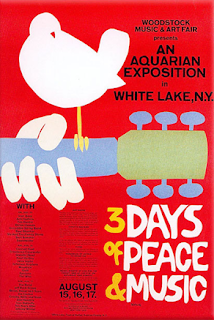

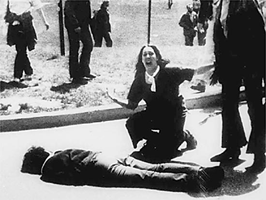

“DOMINOES” sparked so many things in me it’s still difficult to define them all. Extensive footage of protests, both peaceful and violent, brought to mind the recent intense protests at the various World Economic Summits of the world’s G-20 or largest economies. Overlooked by most they have been the ONLY substantive organized protests in the Western world in decades.

While students in Iran risk their lives protesting in the streets to rid themselves of an oppressive regime WHY are Americans not taking to the streets to demand answers like we did in the 60s and 70s. Your guess is as good as mine.